Here’s how we’re spending, and saving, during COVID-19

There’s no doubt we’re living in strange times right now, and with that in mind, we’ve been asking Credit Simple members in Australia about their experiences, and how they’re spending, and saving, during the COVID-19 pandemic.

This recent survey was conducted between Tuesday 19 May 2020 and Wednesday 20 May 2020, and 348 Credit Simple members participated.

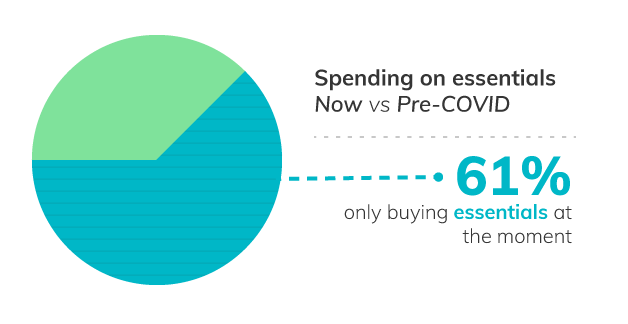

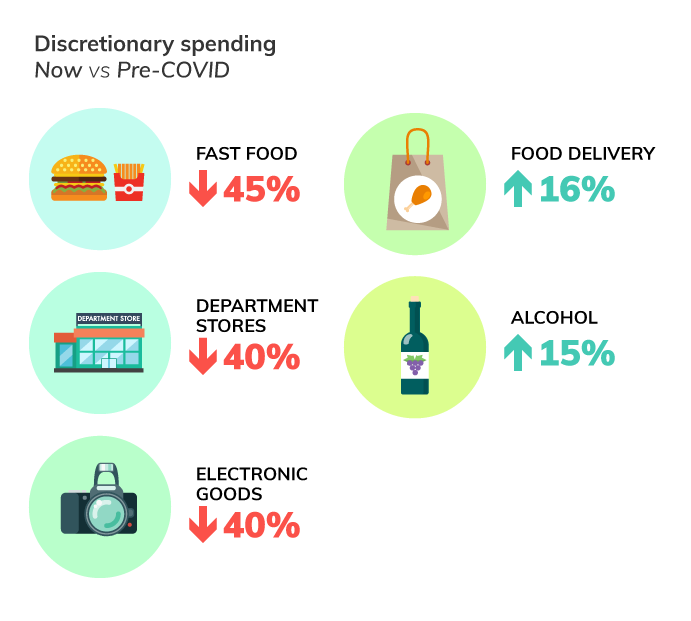

In terms of discretionary purchases, this month, members reported a decrease in spending on fast food, in department stores and for electronic goods, and an increase in spending on food delivery and alcohol.

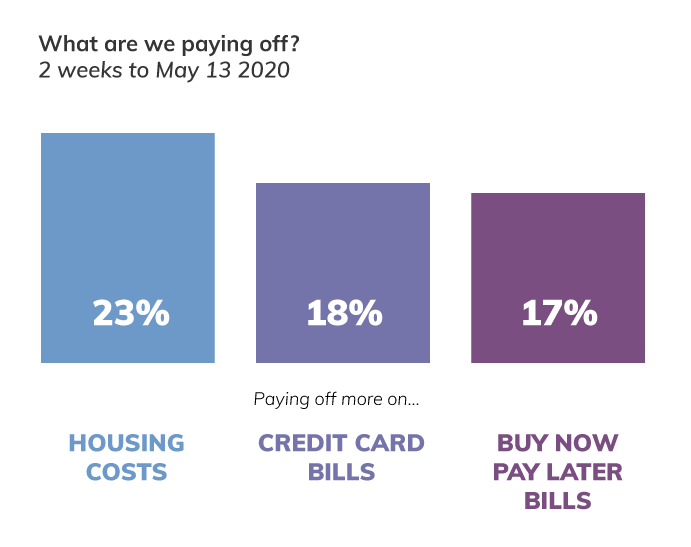

We were also keen to find out whether Credit Simple members are taking this time to pay off any major debts, and it seems that a lot of people are putting more money into killing debt.

Unsurprisingly, some of us are not confident in meeting our future obligations, with 18% of us not sure if we’ll be able to make utilities, rent and mortgage payments in future.

But it’s not all doom and gloom. for those of us who received a stimulus payment, which was just over half of all respondents, almost everyone said it had helped.

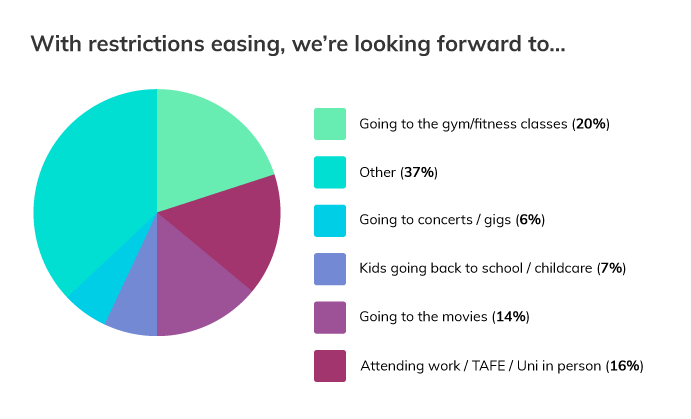

We’re also looking forward to restrictions easing, and getting back to doing things in person.

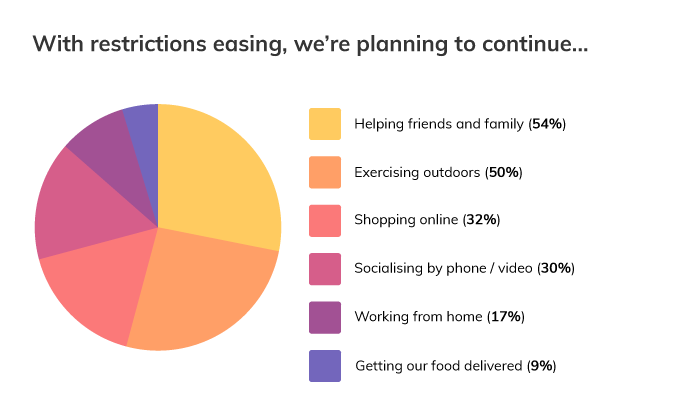

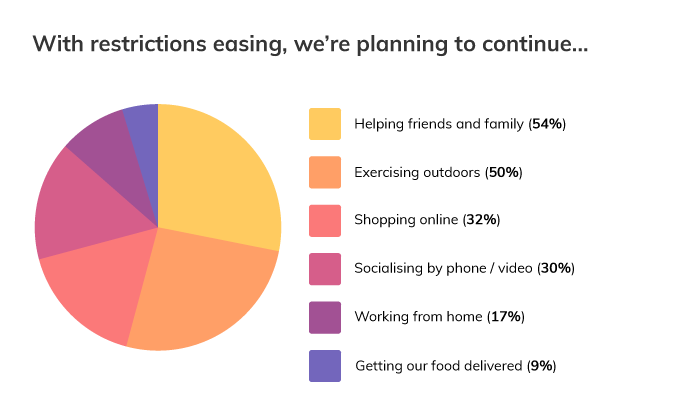

Reflecting on how things have changed, many of us have picked up new habits, and we’re planning to continue them well into the future.

This recent survey was conducted between Tuesday 19 May 2020 and Wednesday 20 May 2020, and 348 Credit Simple members participated.

Find out more

Credit Simple is part of the illion group of companies. illion has partnered with AlphaBeta, to create a weekly economic update, as well as running regular surveys with our members to find out how they’re feeling, spending and saving during the COVID-19 pandemic.

Want to know more? Further data is available here.

Credit Simple

Credit Simple gives all Australians free access to their credit score, as well as their detailed credit report. See how your credit score compares by age, gender and community and gain valuable insights into what it all means.

All stories by: Credit Simple